Description

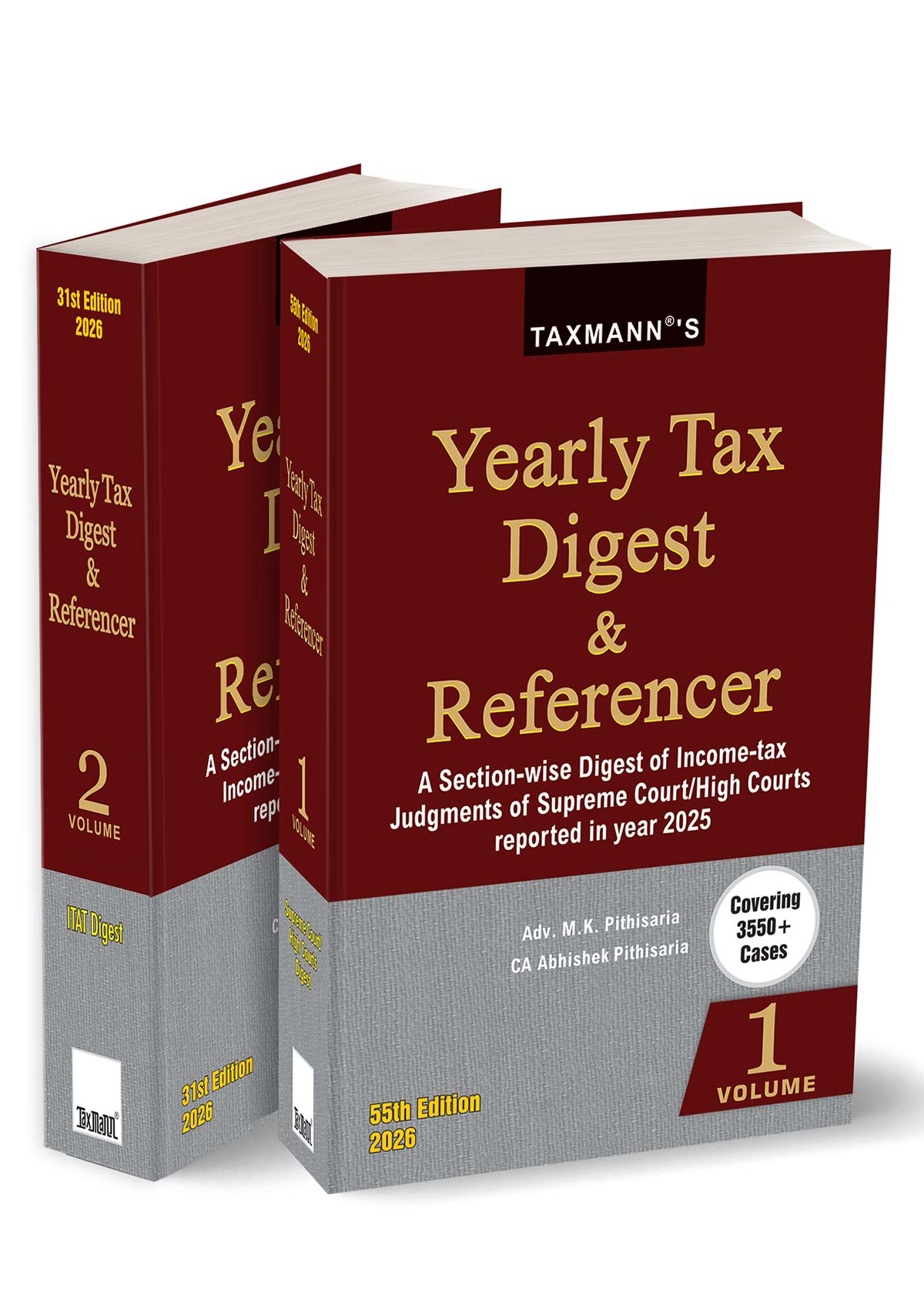

Yearly Tax Digest & Referencer is Taxmann’s flagship annual jurisprudence compendium that documents, organises, and operationalises a full year of income-tax litigation in India. The 2026 Edition presents a complete judicial record of income-tax case law reported during 2025, covering decisions up to date and consolidating 3,550+ reported rulings across courts and tribunals. This publication is a pure judicial digest, editorially designed to answer one core professional requirement:

What has the judiciary held on a given income-tax provision or issue during the year—and how can that holding be reliably cited and applied?

To serve this objective, the Digest is structured as a two-volume set, separating binding and persuasive court precedents from high-density tribunal jurisprudence, while maintaining a unified, section-wise and issue-wise research methodology across both volumes.

This publication is indispensable for professionals who work with case law as a daily decision-making tool, including:

Tax Litigators & Advocates drafting appeals, written submissions, synopsis notes, and precedent compilations

Chartered Accountants & Tax Consultants advising on contentious and high-risk issues

In-house Tax & CFO Teams validating tax positions and litigation exposure

Departmental Representatives & Revenue Officers tracking judicial trends and outcomes

Researchers & Advanced Students specialising in income-tax jurisprudence

It is especially valuable where precedent density, factual distinction, and procedural validity determine outcomes

The Present Publication is the 55th Edition (Volume 1) & 31st Edition (Volume 2), edited by Adv. M.K. Pithisaria & CA. Abhishek Pithisaria. It incorporates all Case Laws reported till 16th November 2025 for the year 2025. The key features of the book are as follows:

[Complete Annual Judicial Record] Exhaustive consolidation of all major income-tax rulings reported during 2025

[Court-segregated Architecture] Separate volumes for higher judiciary and ITAT, respecting precedential hierarchy

[Section-wise & Issue-wise Digesting] Every ruling is mapped to the exact statutory provision and litigation issue

[Precedent-status Intelligence] Dedicated tools to track whether decisions are affirmed, reversed, overruled, or pending before the Supreme Court (Volume 1)

[Circulars & Notifications in Litigation] Special lists identifying CBDT circulars and notifications judicially analysed by courts and tribunals

[Neutral, Non-Commentarial Presentation] Objective distillation of holdings without authorial opinion

[Multi-layer Navigation] Case lists, subject indices, and issue taxonomies enabling instant retrieval

The coverage of the book is as follows:

Volume 1 – Supreme Court & High Courts | It captures binding and persuasive precedents delivered by the Supreme Court and various High Courts during the year. It is editorially designed as a courtroom-ready research tool and includes:

List of Cases Digested (alphabetical)

List of Cases Affirmed/Reversed/Overruled/Approved/Disapproved, enabling instant assessment of precedent strength

List of Cases with SLP Dismissed/Granted/Notice Issued, critical for validating whether a High Court ruling has reached or survived scrutiny at the apex level

List of Circulars & Notifications Judicially Analysed, mapping delegated legislation to judicial interpretation

Section-wise Digest of Judgments, covering the entire Income-tax Act, 1961

Comprehensive Subject Index for cross-sectional issue retrieval

Substantively, the volume spans all major domains of income-tax law, including charging provisions, exemptions, business income, capital gains, international taxation, reassessment, penalties, procedural safeguards, and constitutional principles. Each section is further broken into recognisable litigation issues (for example, under Section 14A, Section 37, Section 68, reassessment provisions, etc.), reflecting how disputes actually arise and are argued in courts

Volume 2 – Income-tax Appellate Tribunal (ITAT) | It is a high-density repository of tribunal jurisprudence, capturing how income-tax law is applied at the most active and fact-intensive stage of litigation. Its structure includes:

List of ITAT Cases Digested

List of Circulars & Notifications Judicially Analysed by Tribunal

Section-wise Digest of ITAT Orders

Detailed Subject Index

The volume is particularly strong on procedural and evidentiary disputes, such as reassessment under sections 147–153, validity of notices, limitation, sanction, faceless assessment mechanics, DIN defects, TDS/TCS compliance, penalties, and business disallowances.

Notably, international tax issues under Section 9 are organised using OECD Model Convention article logic (PE, business profits, royalty/FTS, capital gains, etc.), mirroring how treaty disputes are actually framed before tribunals

The Digest follows a research-first, practitioner-centric architecture:

Multiple Entry Points

Start with a case name → List of Cases Digested

Start with an issue → Subject Index

Start with a circular/notification → Judicially Analysed Circulars List

Start with precedent validity → Affirmed/Reversed/SLP Lists (Vol. 1)

Section-wise Organisation with Issue Sub-Heads – Each statutory section is divided into multiple litigation propositions rather than treated as a single block.

Proposition-based Digests – Entries are distilled into numbered propositions indicating:

the legal issue

assessment year(s)

outcome (in favour of assessee or revenue)

court/bench and citation

brief judicial reasoning

case-history or subsequent treatment, where relevant

Independent yet Complementary Volumes – Each volume can be used on its own, while together they provide a complete, year-specific litigation map

![G. M. Divekar's Practical Guide to Deeds & Documents [In 2 HB Vols. 2025]](https://hindlawhouse.com/wp-content/uploads/2021/03/9788196887384-300x300.jpeg)

![Financial Reporting [for November 2022]](https://hindlawhouse.com/wp-content/uploads/2022/07/SW-300x300.jpg)

![Bharat's Companies Act with Rules [Royal Edition]](https://hindlawhouse.com/wp-content/uploads/2021/03/9788119565887-300x300.jpg)

Reviews

There are no reviews yet.