Description

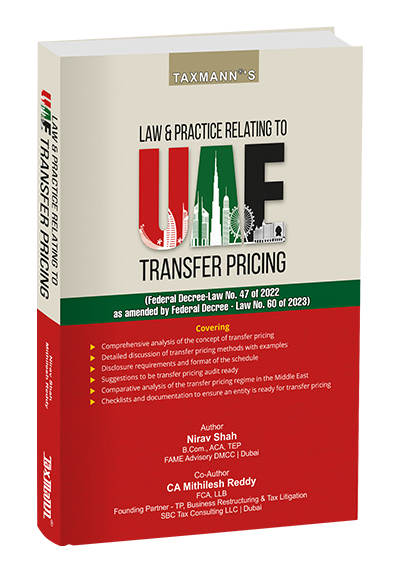

Law & Practice Relating to UAE Transfer Pricing is the first comprehensive treatise on the UAE’s Transfer Pricing (TP) regime, offering a structured blend of statutory law, guidance from the Federal Tax Authority (FTA), OECD-aligned methodology, and practical compliance tools. At its core, the book provides an in-depth analysis of Articles 34–36 and 55 of the UAE Corporate Tax Law, covering Related Party and Connected Person tests, arm’s length principle (ALP) methods, Local/Master File thresholds, and FTA audit expectations. What sets it apart is its UAE-specific focus, particularly on distinctive features such as the deductibility of payments to Connected Persons, the implications of Qualified Free Zone Persons (QFZPs), and the integration of BEPS Action 13 standards within a domestic statutory framework. The treatise moves seamlessly from black-letter law to application, incorporating step-by-step processes, worked examples, checklists, and case-style illustrations. To aid global benchmarking, it also presents comparative tables across KSA, Kuwait, USA, India, and Africa. For ease of reference, the book reproduces the core legal sources—including Federal Decree-Law No. 47 of 2022, the UAE TP Guide CTGTP1, Guidance Paper and key Cabinet/Ministerial Decisions—ensuring that practitioners can consult and apply the primary materials without leaving the volume.

This book is intended for the following audience:

CFOs, Heads of Tax & Corporate Controllers in UAE groups managing domestic and cross-border related-party dealings

Advisors & Assurance Professionals needing a single reference to UAE TP law, FTA practice, and OECD alignment

Free Zone enterprises/QFZPs balancing 0% regimes with ALP, documentation, and de-minimis tests

Multinationals & Family Groups setting policies for services, financing, intangibles, distribution, and intra-group recharges

Litigation & Controversy Teams preparing for FTA audits, appeals, MAP and prospective APAs

The Present Publication is the Latest Edition, authored by Nirav Shah, with the following noteworthy features:

[Article-by-Article Foundations] Clear expositions of Art. 34 (ALP & methods), Art. 35 (Related Parties/Control), Art. 36 (Connected Persons), Art. 55 (Documentation), with practical implications and example matrices

[Documentation Handbook] What to disclose, when and how: TP disclosure form, category-wise thresholds (e.g., AED 40m RPT/AED 500k Connected Persons), Local/Master File contents, flow, common errors, and FTA audit expectations

[Free Zones & QFZPs] Conditions for QFZP status, PE attribution (foreign/domestic), pricing between mainland and free zone entities, and the impact on qualifying income tests

[Tax Groups] Eligibility, consolidation mechanics, elimination rules, and how to attribute taxable income (including lending, interest caps, and corresponding adjustments) within a group

[Dispute Prevention & Resolution] Primer on APA (with regional notes inclusive of KSA guidelines) and UAE MAP—timelines, data packs, and step-through processes

[FTA Audit Handbook] Triggers, information requests, FTA selection of comparable, IQR ranges, timelines, appeal ladder, demand/stay mechanics, and ‘what to fix now’ checklists

[Comparative & BEPS View] UAE vs OECD Guidelines; cross-country charts (KSA, Kuwait, USA, India, Africa); CbCR essentials

[Appendix Library] Reproduces the principal laws, decisions and guidance—creating a one-volume reference

[UAE-centric Nuances] Application of ALP to domestic RP/CP transactions (including Free Zone↔Mainland) and dual tests for Connected-Person deductibility (market value and wholly/exclusively for business)

[Audit Practicality] Highlights typical information packages, benchmarking cadence (three-year refresh; annual financial updates), and FTA preferences (local→regional→other regions; IQR for ranges)

[Author Credibility] Nirav Shah brings 30+ years of international tax experience advising MNEs on structuring, documentation and controversy—complemented by extensive teaching and writing

The coverage of the book is as follows:

Chapter 1 — Introduction to UAE Corporate Tax & Transfer Pricing

Evolution, UAE TP landscape, Articles 34–36 & 55, and FTA clarifications (e.g., interquartile range, local→regional→global comparables, multi-year data, TNMM transaction-specific approach)

Chapter 2 — Related Parties & Connected Persons

Ownership/control tests, kinship up to fourth degree, unincorporated partnerships, trusts/foundations; deductibility tests for Connected-Person payments and exceptions. Practical schematics and scenarios are also included

Chapter 3 — TP Methods & ALP Determination CUP/RPM/CPM/TNMM/PSM/Other Method; tested party; comparability adjustments (including working capital); arm’s-length range using IQR; corresponding adjustments. Comprehensive numeric examples are also covered

Chapter 4 — Documentation

TP Disclosure Form (RP/CP schedules), Local File & Master File contents, flow of documentation, CbCR overview, common errors, and FTA-audit readiness. Thresholds and illustrative templates/checklists are set out clearly

Chapter 5 — TP in Free Zones

QFZP conditions, foreign/domestic PE treatment, de-minimis and attribution rules, with worked pricing examples for Free Zone ↔ Mainland transactions

Chapter 6 — Tax Groups & TP

Eligibility (95% ownership/votes/profits & assets, unified FY), attribution of taxable income, lending within groups, and when intra-group eliminations do not block an ALP-based attribution

Chapter 7 — Dispute Prevention & Resolution

Definitions, global APA types; probable UAE APA process; KSA APA guidelines (for cross-border planning); MAP stages; safe-harbour rules—especially for low value-adding services

Chapter 8 — TP Audits

Global snapshots, UAE audit triggers, information sought, assessment and appeal paths, demand/stay, corresponding adjustments and key takeaways—with case studies (e.g., resale margin; intra-group services without agreements/substance)

Chapter 9 — Comparatives & BEPS

UAE v. OECD table; charts across KSA/Kuwait/USA/India/Africa; BEPS Action Plan implementation; UAE/KSA compliance scenarios

Chapter 10 — Compliance & Penalties

Corporate-tax and TP compliance calendars, thresholds/timelines, scenario-based checklists, special considerations, and penalties (Cabinet Decision No. 75/2023) with business impact notes

Appendices

Federal Decree-Law No. 47 of 2022 (Corporate Tax Law)

FTA Transfer Pricing Guide (CTGTP1)

Ministerial Decision No. 97 of 2023 (TP documentation)

Ministerial Decision [301] of 2024 (Tax Group)

Guidance Paper

Cabinet Decision No. 142 of 2024 (Top-up Tax/Pillar Two)

UAE Mutual Agreement Procedure Guidance

The structure of the book is as follows:

Section-wise Exegesis & Practice Notes – Each rule is followed by ‘what the FTA looks for,’ documentation anchors, and worked examples

Decision Frameworks & Flowcharts – Method selection, tested-party choice, IQR application, attribution inside tax groups, PE attribution for QFZPs

Scenario Analysis – Free zone vs mainland pricing disputes, intra-group services without substance, inter-company loans, thin-cap interactions

Comparative Charts & Tables – For quick jurisdictional benchmarking

![Bharat's Companies Act with Rules [Royal Edition]](https://hindlawhouse.com/wp-content/uploads/2021/03/9788119565887-300x300.jpg)

![CODE OF CIVIL PROCEDURE [HB]](https://hindlawhouse.com/wp-content/uploads/2022/07/8-284x300.jpg)

Reviews

There are no reviews yet.