Description

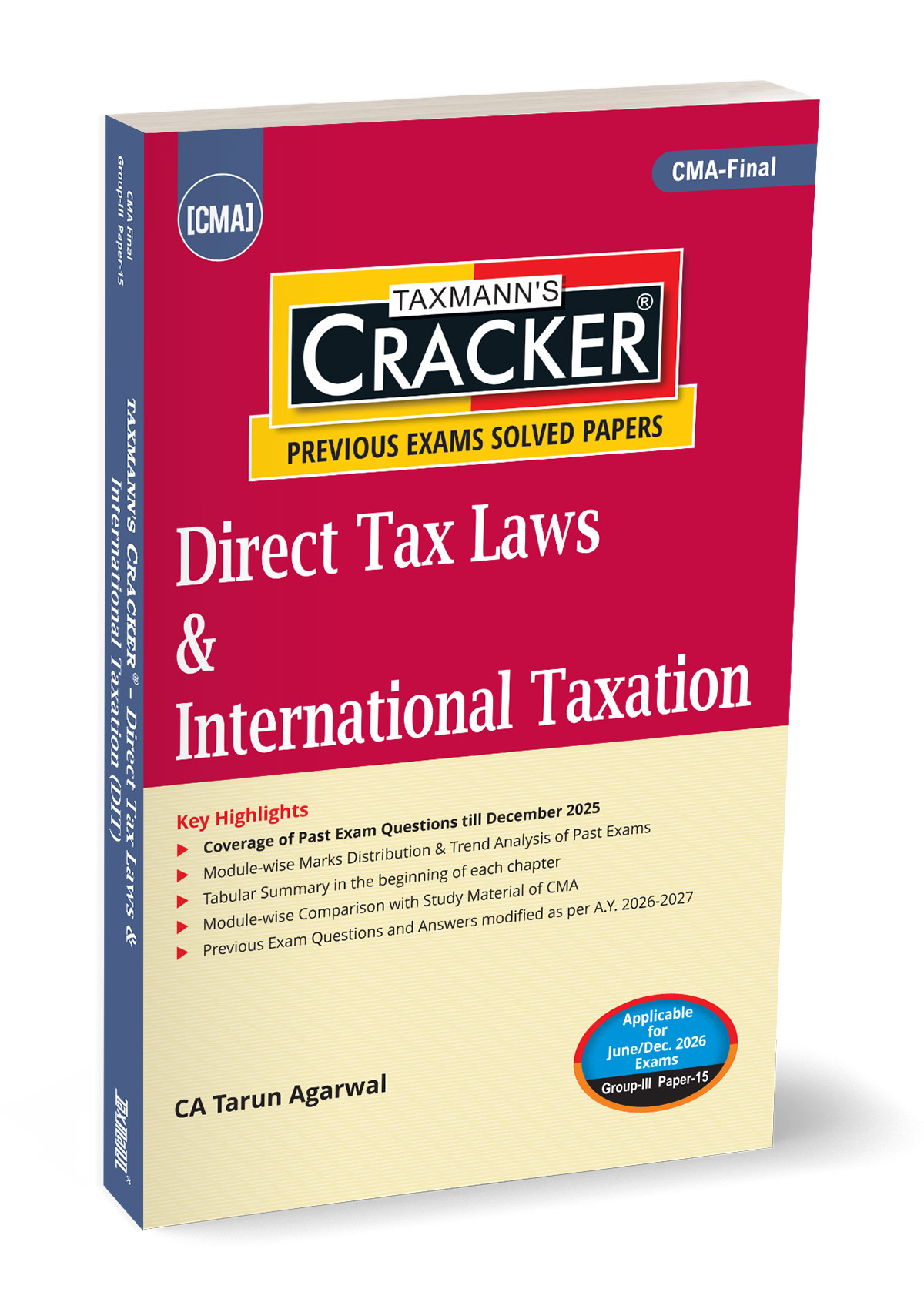

Direct Tax Laws and International Taxation | CRACKER is a comprehensive, exam-oriented practice and revision resource meticulously designed for CMA Final – Group III | Paper 15. This book serves as a strategic companion for aspirants appearing in the June/December 2026 examinations, offering in-depth coverage of fully solved past examination questions up to December 2025, carefully updated in line with the Assessment Year 2026–27. Developed with a clear focus on examination requirements, this CRACKER edition bridges the gap between conceptual understanding and scoring performance by combining solved papers, trend analysis, and structured alignment with the CMA Institute’s Study Material, thereby enabling focused, efficient, and result-oriented preparation.

The Present Publication is the January 2026 Edition, authored by CA. Tarun Agarwal, with the following noteworthy features:

[Exhaustive Coverage of Past Examination Questions] Includes fully solved CMA Final examination questions up to December 2025, presented with step-by-step, exam-oriented solutions

[Module-wise Marks Distribution & Trend Analysis] Detailed analytical tables highlighting historical weightage, frequently tested modules, and evolving examination trends to help students prioritise preparation

[Tabular Chapter Snapshots] Each chapter opens with a concise tabular summary, offering a quick overview of key provisions, concepts, and examinable areas for rapid recall and revision

[Module-wise Comparison with CMA Study Material] Direct mapping of solved questions with the official CMA Study Material ensures syllabus completeness and strengthens conceptual alignment

[Updated as per A.Y. 2026–27] All previous exam questions and answers have been modified and updated to reflect the latest applicable provisions, rates, amendments, and interpretations

The book comprehensively covers the entire syllabus of Direct Tax Laws and International Taxation as prescribed for CMA Final, through:

Systematically arranged past examination questions with detailed solutions

Coverage of Direct Taxes, including income computation, tax planning aspects, and procedural provisions

International Taxation concepts tested in the CMA exams are addressed through exam-oriented problem-solving

Analytical insights into question frequency, marks allocation, and recurring themes

Updated treatment of provisions ensuring relevance for current and upcoming exam cycles

The structure of the book is as follows:

Module-wise Organisation aligned with the CMA syllabus

Chapter-opening Summary Tables for instant orientation

Solved Past Exam Questions presented in a logical sequence for progressive learning

Trend & Marks Analysis Tables interwoven to guide exam strategy

Clear, Structured Answers drafted in a student-friendly, examiner-aligned presentation style

![LAW OF ELECTIONS AND ELECTION PETITIONS [IN 3 VOLUMES]](https://hindlawhouse.com/wp-content/uploads/2022/07/10-288x300.jpg)

Reviews

There are no reviews yet.