Description

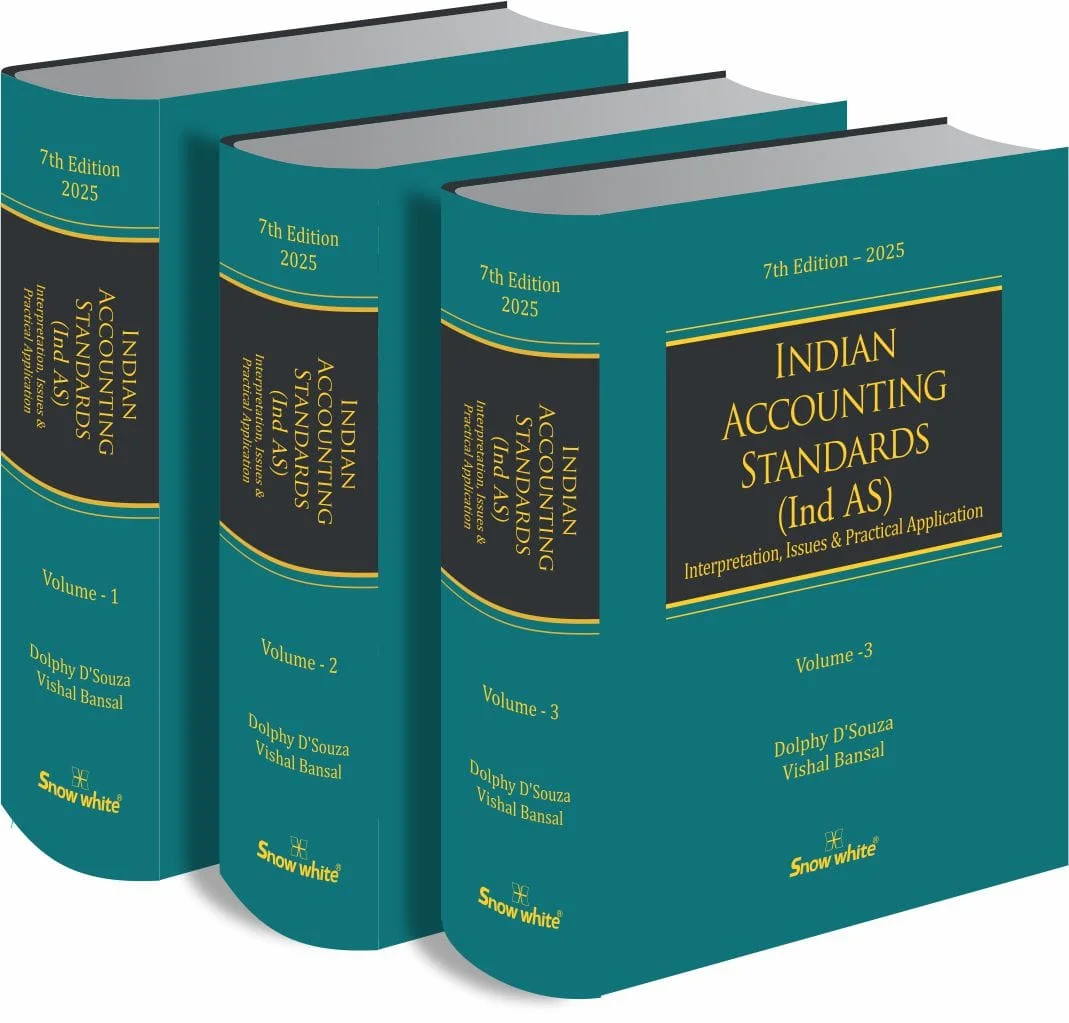

Indian Accounting Standards (Ind AS) Interpretation, Issues & Practical Applications by Dolphy DSouza & Vishal Bansal

This 3-volume set on Indian Accounting Standards (Ind AS) offers a comprehensive interpretation of all notified Ind AS standards, incorporating amendments as per the 2024 Companies Rules. Fully updated for 2025, this edition includes revised chapters, 2,000+ practical case studies, model financial statements, and FAQs. The book explains complex standards in simple language and includes references to expert opinions and IFRS interpretations. It is a trusted reference for professionals handling corporate financial reporting, auditing, and advisory services.

Key Features:

As Amended by the Companies (Indian Accounting Standards) Third Amendment Rules, 2024

All chapters re-written/revised, updated for 2025

Revised Schedule Il Model financial statements and FAQ’s

More than 2,000 Practical Illustrations /Case studies across all Ind AS standards

Complex Ind AS’s (Financial Instrument, Business combination, Debt vs Equity, Revenue Recognition, Leases, Insurance Contracts) explained in a simple language

Includes references to EAC opinions and ITFG/IFRIC interpretations, where necessary

Detailed index facilitating easy reference

Tax implications arising from Ind AS accounting

Ideal For:

Chartered Accountants & Finance Professionals

CFOs and Internal Audit Teams

Corporate Law and Compliance Professionals

Accounting Students and Educators

Reviews

There are no reviews yet.