Description

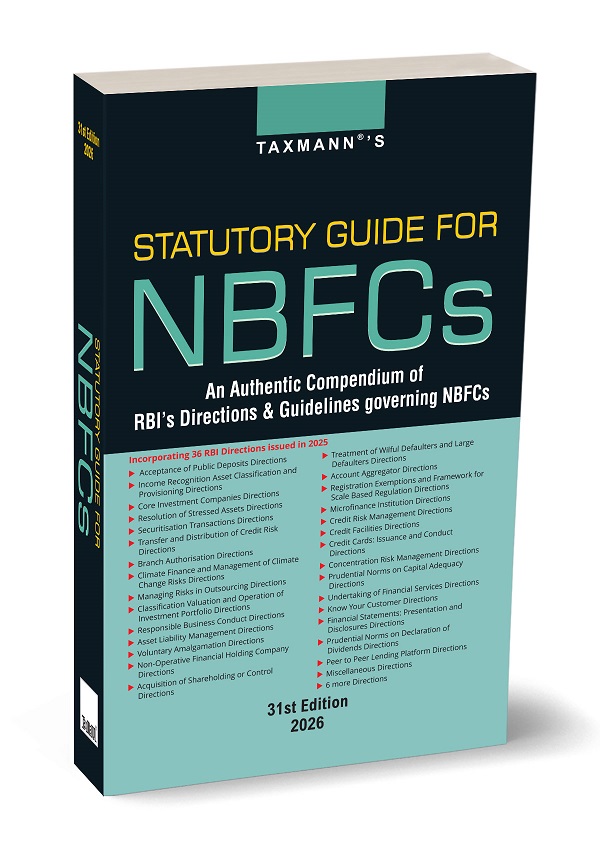

Statutory Guide for NBFCs – An Authentic Compendium of RBI’s Directions & Guidelines Governing NBFCs is a definitive, practice-oriented regulatory compendium that consolidates the entire operative framework issued by the Reserve Bank of India for Non-Banking Financial Companies (NBFCs) and allied regulated entities. Updated with the law as amended and applicable, this publication captures the most mature and comprehensive phase of NBFC regulation in India, reflecting the RBI’s transition to a risk-sensitive, governance-driven, and scale-based supervisory architecture. This book is not a narrative commentary or selective circular compilation. It is designed as a statutory working manual, reproducing RBI’s Master Directions and allied regulatory instruments in their operative form, together with all embedded chapters, annexures, illustrations, reporting formats, and implementation frameworks that professionals actually require to comply with, audit, and evidence regulatory adherence. This Edition is particularly significant as it incorporates 36 RBI Directions issued or consolidated during 2025, a year marked by extensive regulatory rationalisation across prudential norms, conduct regulation, digital lending, climate risk, and governance standards.

This publication is intended for stakeholders who require authoritative, up-to-date, and implementation-ready regulatory text, including:

NBFC Boards, CXOs, Compliance Heads, and Risk Functions (ALM, Credit, IRACP, Capital, Governance, Outsourcing, Conduct)

Internal Audit, Concurrent Audit, & Statutory Audit Teams responsible for regulatory assurance

Chartered Accountants, Company Secretaries, Cost Accountants, & Legal Advisors handling NBFC compliance and governance advisory

Treasury, Securitisation, & Structured Finance Teams working under securitisation and credit risk transfer regimes

HFCs, CICs, SPDs, & Specialised NBFC Categories needing category-specific directions

Policy Teams, Researchers, & Academic Institutions focusing on Indian financial regulation

The Present Publication is the 31st Edition | 2026, updated till 31st December 2025. This book is edited by Taxmann’s Editorial Board, with the following noteworthy features:

[Complete Consolidation of RBI Directions] Brings together the full spectrum of RBI Master Directions and allied regulatory frameworks governing NBFCs and related entities into a single, systematically organised volume

[Incorporation of 36 RBI Directions Issued in 2025] Reflects RBI’s 2025 regulatory consolidation across deposits, IRACP, stressed assets, securitisation, credit risk transfer, governance, disclosures, and conduct norms

[Direction-wise, Statute-first Presentation] Each RBI Direction is reproduced as a self-contained regulatory instrument, preserving its original chapter structure, applicability clauses, definitions, commencement provisions, and annexures

[Practice-facing Utility] Includes operational artefacts embedded within the Directions—such as illustrative computations, disclosure formats, reporting templates, and annexed returns—making the book usable for real compliance work

[Alignment with Scale-Based Regulation (SBR)] Captures differential compliance obligations across NBFC layers and specialised categories under RBI’s scale-based supervisory framework

[Comprehensive Navigation Aids] Supported by a curated List of Master Directions and a detailed Subject Index for rapid issue-to-provision referencing

The book is structured into nine regulatory divisions, covering the entire NBFC compliance perimeter:

Division I | Law Relating to Non-Banking Financial Companies – The core of the publication, consolidating RBI Directions governing NBFC operations, prudential regulation, governance, and conduct, including (inter alia):

Acceptance of Public Deposits

Income Recognition, Asset Classification and Provisioning (IRACP)

Resolution of Stressed Assets

Securitisation Transactions

Transfer and Distribution of Credit Risk

Branch Authorisation

Asset Liability Management and Concentration Risk Management

Credit Risk Management and Credit Facilities

Classification, Valuation and Operation of Investment Portfolio

Responsible Business Conduct (including KFS, APR computation, and borrower disclosure illustrations)

Climate Finance and Management of Climate Change Risks

Managing Risks in Outsourcing of Financial Services

Prudential Norms on Capital Adequacy

Financial Statements – Presentation and Disclosures

Declaration of Dividends

Know Your Customer (KYC)

Account Aggregator Framework

Peer-to-Peer Lending Platform Directions

Microfinance Institution Directions

Miscellaneous and residual regulatory directions

This Division also incorporates critical allied frameworks such as the Information Technology Framework for NBFCs, IT Governance and Assurance Directions, Fraud Risk Management Directions, and the Integrated Ombudsman Scheme

Division II | Mortgage Guarantee Companies – Dedicated coverage of RBI Directions applicable to Mortgage Guarantee Companies

Division III | Housing Finance Companies – Includes RBI (Housing Finance Companies) Directions 2025, along with explicit cross-applicability of relevant NBFC Directions, enabling precise compliance mapping for HFCs

Division IV | Standalone Primary Dealers – Covers RBI (Standalone Primary Dealers) Directions 2025, including prudential, accounting, and disclosure frameworks

Division V | Credit Information Reporting – Includes RBI Directions on Credit Information Reporting, supported by highly granular annexures specifying data formats, segments, and field-level reporting requirements

Division VI | Prescribed Returns – Contains RBI (Filing of Supervisory Returns) Directions, including annexures detailing lists of returns, changes, repeals, and portal-based submission mapping.

Division VII | FEMA (Non-Debt Instruments) Rules 2019 – Provides the FEMA Non-Debt Instruments Rules, recognising the intersection of NBFC regulation with foreign investment and ownership controls.

Division VIII | Insolvency and Bankruptcy Code Provisions for NBFCs – Consolidates IBC provisions relevant to NBFCs, including prescribed forms and procedural requirements

Division IX | Priority Sector Lending Directions – Includes RBI (Priority Sector Lending – Targets and Classification) Directions 2025

The book is meticulously organised into logical divisions and chapters:

Division-based Architecture – Organised by regulatory domain to mirror the way compliance and audit teams approach NBFC regulation in practice

Master Direction Format – Each Direction is reproduced with its RBI circular identifier, date, short title, commencement clause, applicability, and chapter-wise provisions

Embedded Annexures and Templates – Includes illustrative calculations, disclosure tables, reporting formats, supervisory returns, and data submission structures within the body of the Directions

Research-grade Indexing – A comprehensive Subject Index enables quick navigation across regulatory topics, instruments, and compliance areas

![LAW OF ELECTIONS AND ELECTION PETITIONS [IN 3 VOLUMES]](https://hindlawhouse.com/wp-content/uploads/2022/07/10-288x300.jpg)

Reviews

There are no reviews yet.