Description

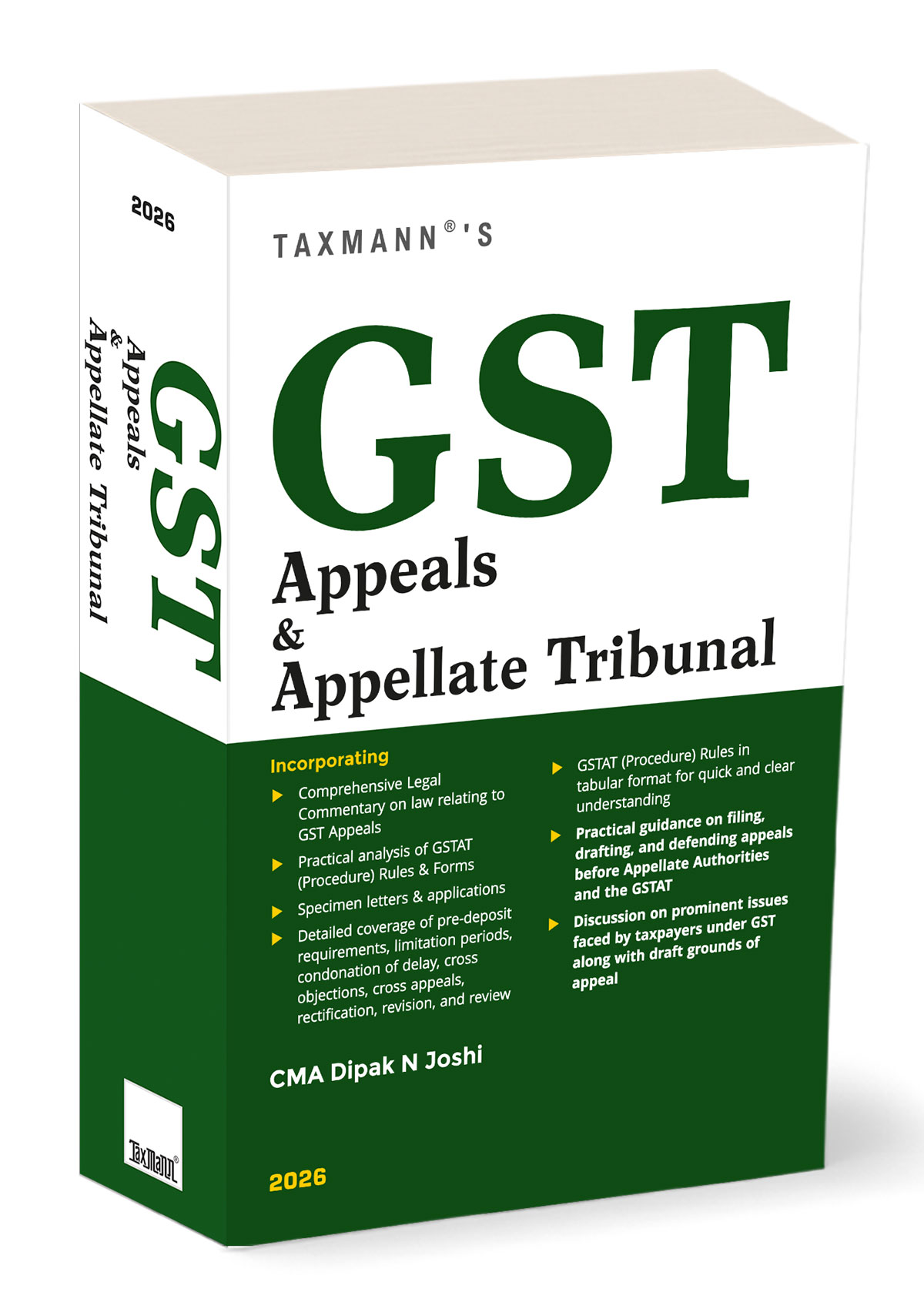

GST Appeals & Appellate Tribunal is an exhaustive, practice-oriented treatise that simplifies the entire appellate framework under India’s Goods and Services Tax law. Going far beyond a standard commentary, this Edition provides a complete procedural walk-through of every stage of the appellate process—from filing the first appeal to presenting matters before the newly constituted GST Appellate Tribunal (GSTAT). Drawing richly on the statutory architecture, the book explains FORM GST APL-01 and APL-05, along with all associated annexures and procedural requirements, in granular detail. It illuminates the mandatory disclosures in an appeal—such as the case summary, statement of facts, grounds of appeal, details of the aggrieved person, classification of goods/services, valuation issues, and pre-deposit computations. The Edition also provides meticulous insights into the GSTAT (Procedure) Rules, including filing mandates, defect rectification, acknowledgement and scrutiny norms, document attestation, and conditions under which the Registrar may accept or return appeals. With specimen drafts, ready-to-use applications, practical guidance notes, and issue-wise drafting strategies, the book bridges the gap between legal theory and day-to-day appellate practice, making it a definitive professional resource.

This book is intended for the following audience:

GST Practitioners, Chartered Accountants, Cost Accountants & Company Secretaries involved in compliance, litigation, representation, and advisory under GST

Advocates & Tax Litigators requiring authoritative guidance on appellate procedures, drafting, limitation, pre-deposit strategies, and defence before GSTAT

Corporate Tax Teams & In-house Counsels dealing with complex disputes, audit objections, departmental communications, and appellate risk management

Departmental Officers & Adjudicating Authorities seeking clarity on procedural obligations, remedies available to taxpayers, statutory timelines, and review mechanisms

Students, Academicians & Researchers specialising in tax law and appellate procedures under the GST regime

The Present Publication is the Latest 2026 Edition, updated till November 2025. This book is authored by CMA Dipak N Joshi, with the following noteworthy features:

[Granular Procedural Commentary] The book explains, step-by-step, the entire process of filing an appeal, including:

Filing APL-01 electronically, and understanding which fields are auto-populated and which require detailed written submissions (e.g., Statement of Facts, Grounds of Appeal)

Complete requirements for APL-05 before the Tribunal, including cause title, party details, act selection, case description, annexure-based statements, and respondent designation

[Comprehensive Explanation of GSTAT (Procedure) Rules] Covers procedural norms such as:

Rule 18 – Form and filing requirements

Rule 21 – Mandatory supporting documents (certified copies of orders, relied-upon documents, attested copies, etc.)

Registrar’s powers to accept or return defective appeals; rectification time limits; scrutiny process

[Specimen Letters, Applications & Draft Pleadings] Includes templates for:

Condonation of delay

Applications for rectification, review, and revision

Requests for adjournment

Draft grounds for common dispute categories

Written submissions & rejoinders

[Practical & Issue-wise Drafting Guidance] Examples include:

How to present a case history as required in Annexure E (with date-wise narration, reference numbers, and actions taken)

How to prepare case summaries and break up tax, interest, penalty, and fee across CGST/SGST/IGST/Cess

[Tabular Presentation of Rules & Forms] The GSTAT Rules are rewritten in clear, comparative tables for faster comprehension

[Deep Insights into Taxpayer Issues & Litigation Trends] Includes practical commentary on:

Valuation disputes

Classification issues (HSN/SAC) and their mandatory disclosure requirements in appeals

ITC denial grounds

Refund-related appeals

Natural justice violations

Penalty and prosecution-linked appeals

[Pre-deposit Compliance & Limitation Strategy] Detailed discussion includes:

Calculating the admitted amount and the disputed amount separately

Validating pre-deposit payments and attaching proof

Filing appeals within the limitation and drafting condonation applications when delayed

The book is structured to provide full-spectrum coverage of:

Appeals Before the Appellate Authority (AA)

Filing APL-01

Mandatory forms, statements, and annexures

Documentary prerequisites

Personal hearing rights and procedural safeguards

Rectification & review provisions

Appeals Before the GST Appellate Tribunal (GSTAT)

Filing APL-05 and its 26+ mandatory fields, including:

Respondent details

Issue categorisation (38 categories prescribed)

Market value of seized goods

Case summary & financial break-up

Statement of Facts

Grounds of Appeal

Registrar’s scrutiny, defect correction, admission & acknowledgement procedures

Revision, Review & Rectification Mechanisms

Revisionary powers of the Commissioner

Grounds for rectification of mistakes apparent on record

Departmental review procedures

Practical drafting strategy

Specimen Drafts & Practical Tools

Filled sample formats for Form APL-01 & APL-05

Templates for appeals against adjudication, refunds, penalties, classification disputes, and ITC reversals

Annexure preparation formats (A, B, C, D, E)

Litigation Strategy & Case-building

How to prepare a persuasive Statement of Facts

Issue framing & drafting of Grounds

Structuring relief sought in the Prayer section

Managing cross appeals & cross objections

Documenting evidence and relied-upon material

The structure of the book is as follows:

Legislative Framework of Appeals — Covers statutory provisions, relevant rules, and judicial interpretations

Appeals Before AA & RA — Explains practical functioning, timelines, and drafting essentials

GSTAT Structure, Powers & Procedures — Detailed exposition of Tribunal hierarchy, registry functions, benches, and hearing mechanisms

GSTAT (Procedure) Rules in Tabular Format — Rule-wise dissection with explanations and comparable illustrations

Drafting Section — Realistic, practitioner-tested specimens with annotations

Practical Problems & Case-based Solutions — Identifies recurring disputes and provides model solutions, strategic drafting, and litigation checklists

![CODE OF CIVIL PROCEDURE [HB]](https://hindlawhouse.com/wp-content/uploads/2022/07/8-284x300.jpg)

Reviews

There are no reviews yet.