Description

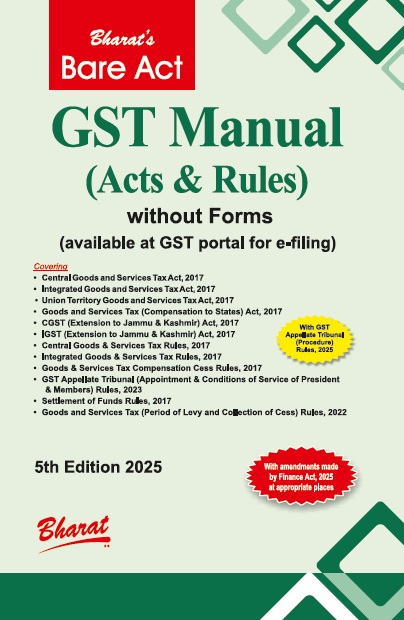

Goods and Services Tax Covering:

Chapter 1 Central Goods and Services Tax Act, 2017

Chapter 2 Integrated Goods and Services Tax Act, 2017

Chapter 3 Union Territory Goods and Services Tax Act, 2017

Chapter 4 Goods and Services Tax (Compensation to States) Act, 2017

Chapter 5 Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017

Chapter 6 Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017

Chapter 7 Central Goods and Services Tax Rules, 2017

Chapter 8 Integrated Goods and Services Tax Rules, 2017

Chapter 9 Goods and Services Tax Compensation Cess Rules, 2017

Chapter 10 Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2023

Chapter 11 Goods and Services Tax Settlement of Funds Rules, 2017

Chapter 12 Goods and Services Tax (Period of Levy and Collection of Cess) Rules, 2022

Chapter 13 Goods and Services Tax Appellate Tribunal (Procedure) Rules, 2025

Reviews

There are no reviews yet.